Newbow highlights the benefits of a homegrown supply chain

Posted on 10th April 2024

Challenges across the aviation supply chain continue to persist and these have been well documented in the media, as the industry grapples with the post-pandemic fallout, in addition to the volatility surrounding price increases, as a result of Brexit and other geo-political turbulence.

New research data sheds light on the current business climate, as UK manufacturers say that it’s harder to do business now than during the pandemic. Some 83% of manufacturers said that the past six months have presented significant challenges, citing interest rate increases (40%), upward pressure on wages (26%), and increasingly complex global supply chains (23%).

With such challenging economic conditions, UK manufacturers are streamlining their operations and costs, focusing on protecting margins and incorporating AI into supply chains, as a means of reducing staff numbers. Many manufacturers, previously reliant on overseas suppliers, have started to ‘reshore’ their supply chains, a process in which companies move production from overseas to the countries where goods are sold.

According to businesses which have gone through a reshoring process, research suggests that the majority (90%) have claimed successful outcomes, including enhanced value and security, plus a reduction in costs. Over the next two years, 82% of manufacturers are planning to increase the pace of reshoring within their supply chains.

When asked about the biggest barriers to reshoring, business leaders stated concerns about rising prices (38%), followed by rising operational costs (32%), and concerns about supplier management costs (27%). Manufacturers also said their reshoring plans will require more staff in the UK (47%), including specialists to help with the reshoring process.

Propelled by the opportunity for a more secure supply chain and lower costs, business leaders are also encouraged by technological advancements, saying AI driven tracking platforms (31%) and data analytics for risk management (29%) are enabling the move towards reshoring.

As manufacturers say they intend to increase the pace of reshoring projects within the next two years, for customers, they expect the key benefits to be cheaper products as business costs come down (35%), the ability to have the products they want faster (34%), and higher quality products (33%). Producing onshore is also expected to have wider ramifications for how the economy operates at large, as multiple different industries benefit from having production onshore.

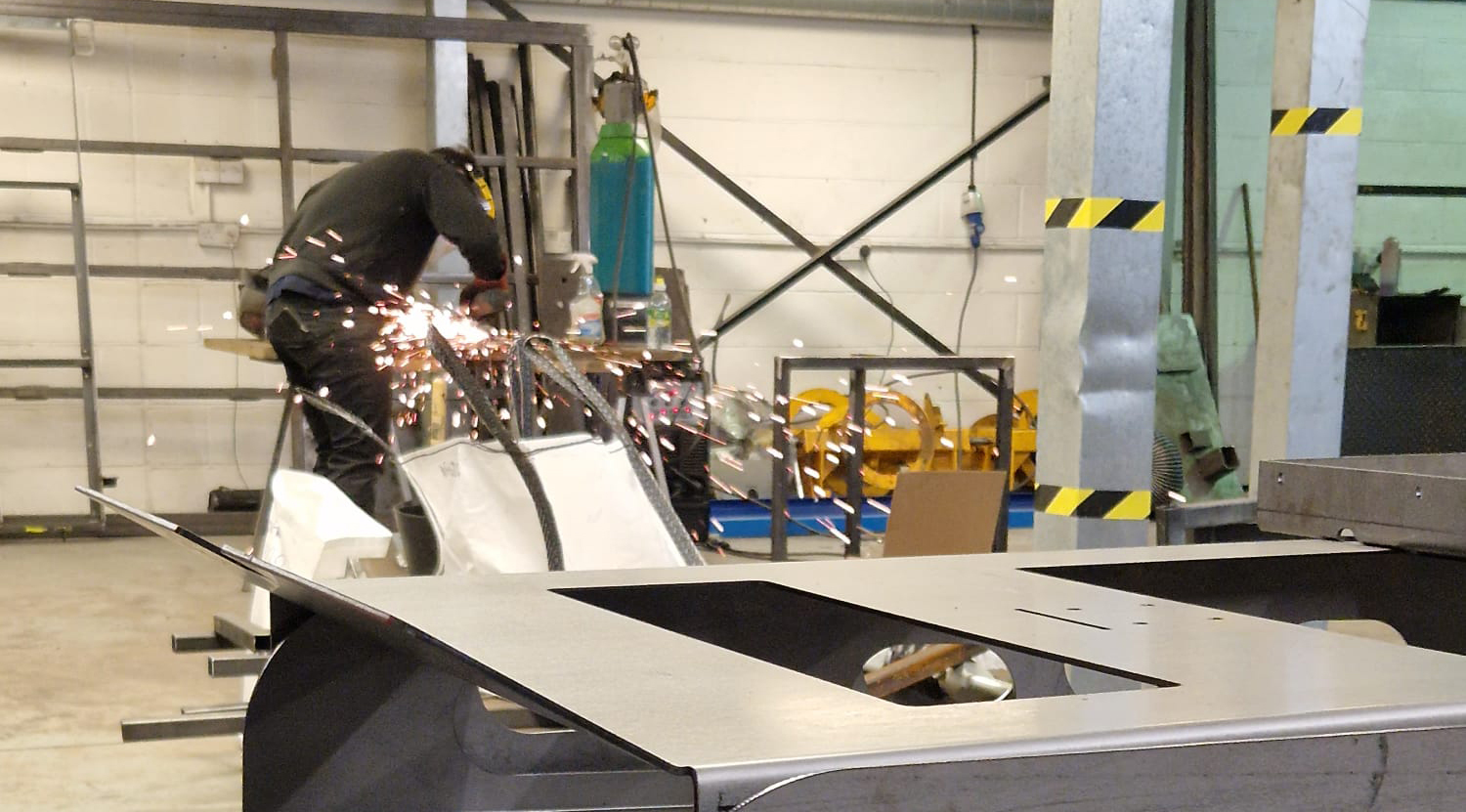

From an aviation perspective, Redditch-based ground support equipment manufacturer, Newbow Aerospace, already has the majority of its supply chain based within 100 miles of its factory. In terms of the biggest issues the company has had to contend with since the end of the pandemic, increasing lead-time and a lack of availability of components have been by far the most challenging.

In response, Newbow took the decision to dual source on some key components, in order to alleviate the unacceptably long lead-times, which did not fit the company’s business model for delivering fast turnaround of projects.

For example, pre-pandemic, one of its long standing suppliers of pressure valves would typically supply products within 6 to 8 weeks, which accommodated Newbow’s production schedule in a timely fashion. Post-pandemic, their lead-time jumped to around 16 weeks, which had a major knock-on effect to the availability of Newbow’s ground support equipment products for its customers. Within the aviation industry, such lengthy lead-times have massive ramifications, so there was no choice but to seek a new supplier of pressure valves, which Newbow managed to secure.

Newbow has continued its strategy of dual sourcing many of the components and raw materials in order to mitigate supply risks moving forward. The business anticipates that pressure will remain on supply chains throughout 2024, so wherever possible it endeavours to source items in the UK. A number of its suppliers are already based in the West Midlands.

With more targets being set upon airports and airlines to meet sustainability goals of reduced CO2, Newbow is also focused on increasing its ‘greener’ offering within the GSE sector. Its recent launch of the aviation industry’s first wheel and brake trailer featuring onboard solar power has the added benefit of reducing operating costs thanks to the harnessing of solar energy.

Marc Green, Sales Director of Newbow Aerospace, said:

“In line with the major advancements happening across the aviation industry to achieve the objectives set out in the Fly Net Zero pledge, Newbow expects to see a significant rise in demand for more sustainable GSE solutions. The availability of lightweight, flexible solar panels now gives us the scope to develop products which will contribute to more sustainable airport ramp operations. Our focus on mitigating any future supply chain risks by increasing our network of UK-based trusted suppliers is also proving to be the right strategy.”In 2021, at the annual general meeting of the International Air Transport Association (IATA), a resolution was passed by IATA member airlines committing them to achieving net-zero carbon emissions from their operations by 2050. The objective of this collective pledge, called Fly Net Zero was to bring air transport in line with the objectives of the Paris Agreement to reduce global warming to below 2°C by that date.

Supporting the global aviation industry for over fifty years, Newbow Aerospace is a leading manufacturer of ground support equipment, including nitrogen carts, calibrated gauges, hoses, regulators, wheel and brake change trailers and other tools and equipment.

Please check our products page for more information.

Share this post: